April 18, 2018 —  Two years ago, Michigan’s largest utility, Consumers Energy, sought state approval to build a US$15 million electric vehicle charging network paid for by ratepayers. It was the first plan of its kind in Michigan, and sought to position the state as a “leader in renewable transportation.”

Two years ago, Michigan’s largest utility, Consumers Energy, sought state approval to build a US$15 million electric vehicle charging network paid for by ratepayers. It was the first plan of its kind in Michigan, and sought to position the state as a “leader in renewable transportation.”

However, the plan raised a series of policy questions. Should people who don’t drive EVs be required to subsidize EV infrastructure? Where will the stations be located? And what about the implications for private charging companies?

Ten months later, Consumers formally withdrew the plan based on widespread opposition. But it wasn’t a total loss. The proposal sparked a deeply involved stakeholder process by the Michigan Public Service Commission (MPSC) to address the policy questions around EVs and how Michigan — the automotive capital of the world — can be a leader. The first utility pilot programs for charging stations and rate structures are expected soon. With the right “price signals” and properly locating charging stations, the MPSC says all utility customers could benefit from “increased electrification of the transportation sector.”

Michigan isn’t alone in navigating the public policy waters around mainstreaming electric vehicles. Forty-three states and the District of Columbia took more than 200 legislative or policy actions last year related to EVs. And none too soon: 7 million electric vehicles are expected to be on U.S. roads by 2025, up from about 740,000 at the end of 2017, as the price of EVs approaches parity with that of gasoline-powered vehicles and public charging stations become increasingly available.

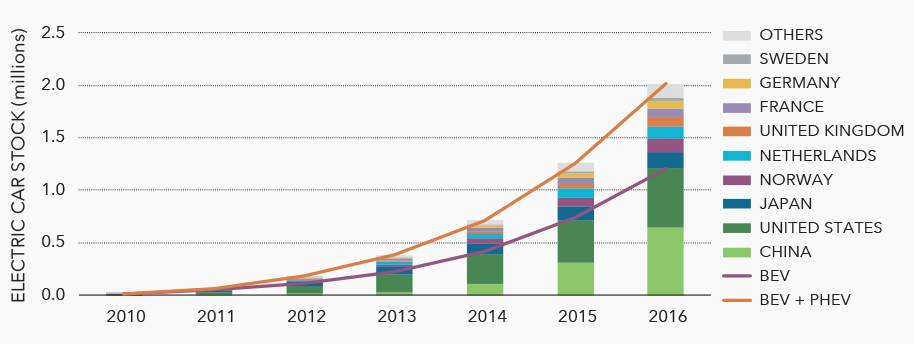

The number of electric cars on the road has grown dramatically in recent years, with battery electric vehicle (BEV) uptake consistently ahead of the uptake of plug-in hybrid electric vehicles (PHEVs). See Global EV Outlook 2017 for sources and details. © OECD/IEA, 2017, Global EV Outlook 2017, IEA Publishing. License: www.iea.org/t&c. Click to expand.

At the same time, utilities and clean energy groups have formed a rare alliance around EVs, which can not only reduce greenhouse gas emissions but also provide a revenue lifeline for power companies facing decreasing or stagnant electricity demand.

The growing interest in EVs portends big changes in infrastructure, from gas stations to mechanic shops to electric utilities to tax structures and the wiring in our own garages. What can we learn from early-adopter communities about what it will take to gear up for EVs?

Encouraging the Transition

Many states and utilities are setting into place incentives to spur adoption of EVs. These include rebate programs to get the sticker price into range of traditional internal combustion, gasoline-powered vehicles; providing recurring incentives to owners, like the right to use high-occupancy vehicle (HOV) lanes or discounted or free parking; and requiring automakers to sell a certain percentage of zero-emissions vehicles (ZEVs) based on overall sales. A review by the North Carolina Clean Energy Technology Center found 17 states “considered policy changes to encourage electric vehicle market development.”

One big one is encouraging the development of infrastructure needed to charge EVs. The Edison Electric Institute (EEI), a trade group representing investor-owned electric utilities in the U.S., projects nearly 5 million charging stations will be required to accommodate 7 million electric vehicles on the road.

Kellen Schefter, manager of sustainable technology at EEI, says charging infrastructure is “a lever our companies could pull. If they could help get more charging infrastructure out there, that will drive EV adoption.”

Yet paying for that infrastructure is an ongoing discussion in states. Often, utilities propose to charge all of their ratepayers for the cost of building stations only EV drivers would use. That EV charging can actually benefit all ratepayers — if done correctly — is becoming clearer and could justify public funding.

“There is no business case in public [charging] infrastructure,” says Gil Tal, research director at the Plug-in Hybrid and Electric Vehicle Research Center at the University of California, Davis. “We need communities, the public and utilities to help support it in the early phase.”

Grid Impacts

For utilities to underwrite charging infrastructure — be it rebates for home chargers or paying for public chargers — regulators need to know whether all ratepayers and the grid benefit beyond the immediate impacts of fewer greenhouse gas emissions.

John Farrell, director of the Energy Democracy Initiative at the Institute for Local Self-Reliance, says the EV deployment level now does not hurt the grid — since EVs make up about 1 percent of the cars on the road worldwide — but concerns are likely to grow as more drivers charge their vehicles.

If companies incentivize or enroll customers in programs for charging during off-peak times of demand, however, “that improves the efficiency of the system and puts downward pressure on our electric rates,” Schefter says. “In an environment where other things cause costs to go up, we see electric vehicles as balancing those costs a bit.”

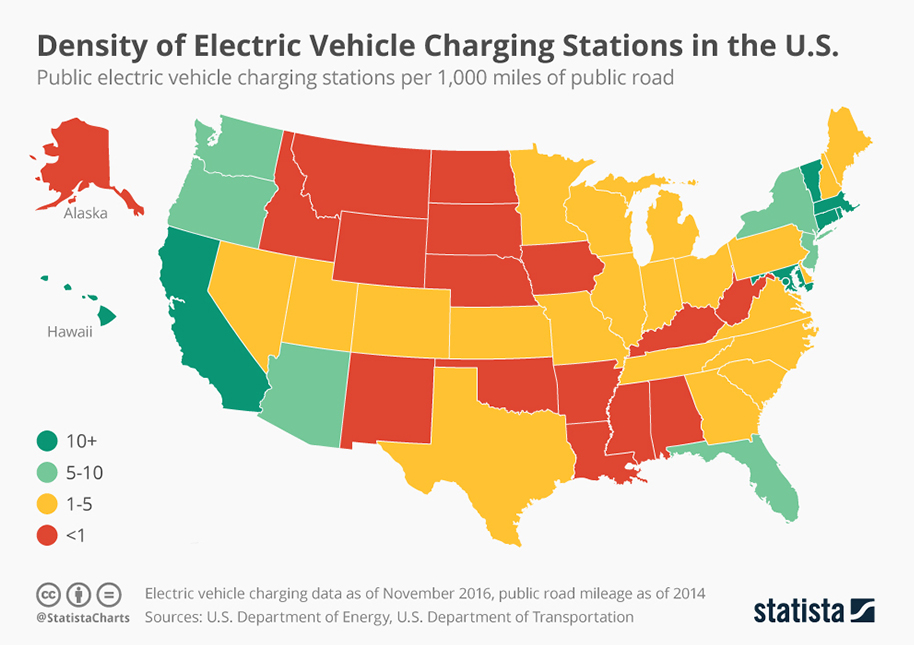

The availability of charging stations can play a big role in consumers’ willingness to purchase an electric vehicle. Image courtesy of Statista. Click to expand.

California — home to roughly half of the electric vehicles in the U.S. and where ZEVs’ market share increased from 3.6 percent to 4.5 percent from 2016 to 2017 — is proving to be a test case on infrastructure build-out and charging programs for other states, Farrell says. The American Council for an Energy-Efficient Economy recently highlighted Southern California Edison’s options for EV drivers that include tiered rate designs — a traditional billing plan based on energy usage — as well as time-of-use rates that are cheaper when grid demand is low. Southern California Edison is also among the few utilities exploring the potential of smart charging, which finds the best time for charging based on electric rates and grid demand. In this case, EV drivers have pricing options based on their flexibility to charge.

Two more California utilities — Pacific Gas and Electric Co. and San Diego Gas & Electric — are also piloting infrastructure programs calling for thousands of public charging stations.

Tal says maximizing grid resources also depends on the source of generation. For example, places like California and Minnesota with excess solar power during the day may encourage drivers to charge then, most likely at work.

“At the end of the day, the potential is there for serving a substantial amount of increased load with minimal investment in new assets.” – Dan BowermasterDan Bowermaster, electric transportation manager with the Electric Power Research Institute, says utilities could take a page from the telecommunications playbook when it comes to pricing incentives.

“The idea is like free minutes during nighttime and weekends,” he says. “What if utilities came up with free lunch-time charging? The point is, for most people there is a lot of flexibility. At the end of the day, the potential is there for serving a substantial amount of increased load with minimal investment in new assets.”

Utilities are also piloting programs that automatically enroll customers in variable-pricing programs whose rates are based on real-time changes in grid load and allow them to opt-out, as opposed to requiring them to opt in.

“That’s probably the right way to do it,” Farrell says. “The great thing about it is we’ve been kind of dumb about the way we’ve used the grid so there are a lot of opportunities for savings.”

Regulatory Changes

Across the U.S., state utility regulators are leading the policy discussion around charging rate structures, utility rebates and deciding who pays for charging infrastructure. States such as Illinois and Michigan have recently assembled stakeholders around these policy unknowns.

Michigan Public Service commissioner Norm Saari said the agency’s review focuses on four points ahead of utilities’ formally filing EV programs: customer access to information, the impact on the grid, infrastructure deployment and rate design.

“We don’t try to predict what the future will be,” Saari, a former Consumers Energy official, says. “Nevertheless we think there is the potential for concern when tens of thousands of electric vehicles will be plugged into a charger.”

Another key component of public EV charging involves the reselling of electricity. In places where that’s prohibited, station owners charge flat hourly rates rather than charging for use by kilowatt-hour.

In its 2017 annual review, the North Carolina Clean Energy Technology Center (NCCETC) notes that rules for reselling electricity “vary significantly” across the U.S., and in some cases it’s unclear whether it can be resold at stations. The report says regulators in four states — Alabama, Delaware, Indiana and Pennsylvania — considered the issue last year.

Revenue Impacts

With more electric vehicles on the road, states and the federal government would in turn see less revenue from gasoline taxes than they would if those vehicles were gas-powered. The NCCETC report says the most common state policy actions involved “additional registration or other fees for electric vehicle owners.”

Until now, states have commonly approached the issue with annual registration fees for EV drivers. Yet experts say this is largely punitive and not a long-term solution. Also, it’s not particularly reflective of road use if an EV driver is charged the same if they drive 1,000 miles a year or 10,000 miles a year.

The American Civil Liberties Union has fought VMT programs in states that use GPS tracking devices to measure mileage.U.S. Rep. Sam Graves from Missouri, advocates a tax based on vehicle miles traveled (VMT) as an alternative to increasing the federal gasoline tax. While some states, including Oregon and Colorado, have piloted the idea, the proposal faces obstacles among conservative lawmakers and privacy advocates. The American Civil Liberties Union has fought VMT programs in states that use GPS tracking devices to measure mileage, instead supporting options such as annual odometer readings.

Advocates see room for growth with performance-based taxes that not only account for, say, vehicle miles traveled, but also more sophisticated regional-based measures that consider energy consumed, vehicle weight and how many people are in the vehicle, Tal says.

Jürgen Weiss, an economist and principal at The Brattle Group, agrees.

“The right way to charge for using roads has to do with how often you use the roads and may have to do with how heavy your vehicle is,” he says. “Over time we’ll definitely have to think about another way of doing it.” ![]()

Ensia shares solutions-focused stories free of charge through our online magazine and partner media. That means audiences around the world have ready access to stories that can — and do — help them shape a better future. If you value our work, please show your support today.

Yes, I'll support Ensia!

However, Andy Balaskovitz. Your words: "Michigan — the automotive capital of the world."

How did you determine that? If you were thinking of the 1960s, I believe you'd be right. Today? I'm not so sure.

Michigan COULD be a leader in the electric vehicle sector. However, it seems to me that USA and Canadian dealers are still emphasising the sale of bigger pickup trucks, rather than small and medium size electric vehicles.