September 18, 2018 — Carbon pricing is like good dental hygiene: It involves a bit of pain and expense but provides many benefits, including saving money, for years to come. Increasingly U.S. politicians across the spectrum are beginning to see both the necessity and benefits of good carbon hygiene.

This backgrounder provides basic information on the why and what of carbon pricing, its impacts on emissions and the economy, and who in the world is doing it.

Why Price Carbon?

It’s commonly accepted that those who produce pollution should pay to prevent damage to human health, property or the environment. Burning fossil fuels (oil, coal and gas) produces carbon dioxide, the main driver of climate change. Climate change in turn creates societal costs by increasing the intensity of extreme weather events, contributing to flooding and forest fires, raising sea levels, acidifying oceans, increasing biodiversity losses, increasing the spread of vector-borne diseases like dengue, and much more.

By increasing the cost of activities that produce carbon, carbon pricing incentivizes practices that reduce emissions, makes fossil fuels more expensive relative to low-carbon fuels, encourages energy efficiency and makes nonpolluting forms of energy more cost competitive.

There are two main ways to put a price on carbon: by levying a carbon tax and by using a cap-and-trade approach.

Carbon Tax

A carbon tax puts a price on the CO2 emitted. Governments set a price per metric ton based on the estimated societal costs of that carbon and apply it to power utilities, oil companies and other industries that emit CO2.

In addition to disincentivizing CO2 emissions, a carbon tax also generates revenue. In many cases, the governments either distribute the revenue to taxpayers or use it to fund clean energy programs and help those who might lose their jobs in the transition to a low-carbon economy.

In Sweden, which instituted a carbon tax in 1991, fossil-fuel-free transportation is an everyday affair. Photo © iStockphoto.com/olaser

British Columbia returns its carbon tax revenues to the public via income tax cuts. Mexico’s and Chile’s modest carbon taxes (US$5 per metric ton) fund social programs. In Sweden, which has had a carbon tax since 1991, 50 percent of the revenue stays with the government, and the rest is returned to the public through income tax cuts.

Researchers participating in the Stanford Energy Modeling Forum modeled 39 different carbon tax scenarios for the U.S. with carbon prices of US$25 or US$50 per metric ton (1.1 tons) starting in 2020 and rising at 1 percent or 5 percent per year until 2050. All resulted in substantially fewer carbon emissions at modest economic costs that are offset by the avoided costs of climate damage and health savings from reduced air pollution.

A US$40 per ton carbon tax could put nearly US$2,000 in the pockets of a family of four in a single year.Supported by four major oil companies, including Exxon, the Climate Leadership Council is lobbying for a U.S. national carbon tax. Its plan would return the carbon tax revenue to taxpayers as a dividend. A US$40 per ton carbon tax could put nearly US$2,000 in the pockets of a family of four in a single year, based on a Treasury Department report on a similar plan. And, despite higher energy prices, about 70 percent of Americans would see their after-tax income increase.

And that dividend would grow as carbon prices rise to a projected US$50–US$450 per metric ton in order to reduce carbon emissions to 80 percent below 2005 levels by 2050.

“Our polling shows Americans are two to one in favor of our carbon dividend plan, and millennials favor it four to one,” says Ted Halstead, the council’s founder and CEO.

A new study by leading economists in the journal Nature suggests that a check in the mail for households has advantages over tax cuts or green spending. The poorest households would benefit most through a carbon dividend payment system, the study concluded.

“Carbon pricing will not work unless people clearly see what they are getting out of it,” co-author Cameron Hepburn of the University of Oxford said in a press release.

Cap and Trade

A cap-and-trade approach to carbon pricing is bit more complicated. It sets a cap on the total amount of carbon an industry is allowed to emit. Companies are given or sold annual carbon emission permits that decrease over time. A company with emissions below the cap can sell its permits to another company whose emissions exceed its cap, thus avoiding a penalty. This creates a supply-and-demand marketplace without governments setting a carbon price (although some may set a floor or ceiling on the permit price).

If the price of pollution permits or the penalty for exceeding the cap is high enough, companies will invest in low-carbon solutions. If the price of pollution permits or the penalty for exceeding the cap is high enough, companies will invest in low-carbon solutions. However, if they are too low, not much happens. This largely has been the case since the European Union created the world’s first cap-and-trade system in 2005. Many free permits were given to get industries on board. Coupled with the 2008 financial crisis, this kept the permit price well below US$10 per metric ton until reforms were put into place in 2017. In addition, the system covers less than 50 percent of the region’s carbon emissions. The entire system is being revised to tighten emission limits, reduce handouts of free permits and pull excess permits off the market if their price falls too low. Revisions will take effect in 2021.

California has had a cap-and-trade system since 2012. Its permit price has averaged less than US$15 per metric ton the past few years. And, like nearly all cap-and-trade systems (as well as carbon tax systems), some sectors of the economy are exempt. Roughly 85 percent of California’s emissions are covered, which is one of the highest in the world.

Comparisons Difficult

Every carbon tax and cap-and-trade system is uniquely designed to fit local circumstances, making comparisons difficult. Generally, since cap and trade puts a ceiling on emissions that lowers over time, it offers more predictability about reaching a specific emissions reduction target. A carbon tax provides stable carbon prices so industry and entrepreneurs can make investment decisions without having to worry about fluctuating changes in cost of carbon.

Carbon price, share of emissions covered and revenues of implemented carbon tax (blue) and cap-and-trade (green) initiatives. Size of circle reflects relative size of revenues. See source (p. 23) for details; click to expand. Source: World Bank’s State and Trends of Carbon Pricing 2018, licensed under CC BY 3.0 IGO</a.

However, a new IMF working paper has modeled how the two systems might work for G20 countries. The analysis suggests that when a carbon tax covers carbon emissions from a country’s fossil fuel supply, it will raise substantially more revenue than today’s cap-and-trade plans. And it would be better at cutting emissions since the tax would apply to all emission sources, not just large industrial emitters such as power plants. In addition, the paper concludes that carbon pricing reduces deaths from local air pollution due to fuel combustion by roughly the same proportion as the CO2 reduction, making it worth implementing even if climate change weren’t an issue.

Not Enough

According to the World Bank Group publication “State and Trends of Carbon Pricing 2018,” 45 national and 25 subnational jurisdictions currently have a carbon pricing structure in place, with prices ranging from less than US$1 to US$139 per metric ton. In addition, more than 1,300 companies use or plan to use carbon pricing this year or next, with prices ranging from US$0.01 to US$909 per metric ton. Companies don’t actually pay this price, but use it as a hypothetical or shadow price in their accounting to prepare for the day when a real carbon price is in place.

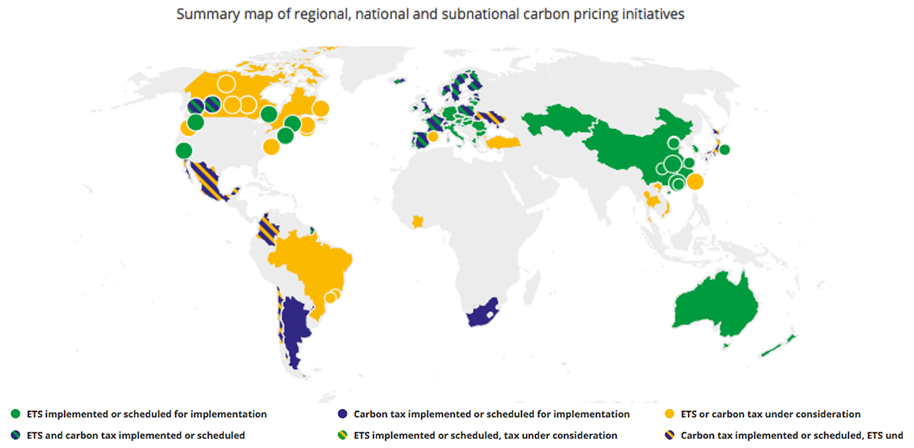

Click image for an interactive graphic showing location of carbon pricing initiatives, greenhouse gas emissions covered, carbon price and annual value, 1990–2018. Source: The World Bank Carbon Pricing Dashboard. carbonpricingdashboard.worldbank.org/map_data

The Carbon Pricing Leadership Coalition estimates that carbon prices will have to be between US$50 and US$100 per metric ton by 2030 for countries to meet their Paris Agreement emission reduction targets without other emission reduction policies. This would generate considerable resistance from affected industries and be difficult for governments to put in place across all sectors, some energy economists say.

International energy experts writing in the journal Nature Climate Change suggest a package of climate policies to complement a carbon price that include boosting energy efficiency, switching to low-carbon fuels (such as from coal to gas), increasing renewable energy, and removing carbon through practices such as planting trees and changing some agricultural practices. Their conclusion: A well-planned climate policy package that includes a carbon price is the way to achieve an efficient, just and publicly acceptable decarbonization transition. ![]()

Ensia shares solutions-focused stories free of charge through our online magazine and partner media. That means audiences around the world have ready access to stories that can — and do — help them shape a better future. If you value our work, please show your support today.

Yes, I'll support Ensia!

This article does a great job of explaining the differences of CFD vs Cap and Trade. Since many state constitutions require gasoline taxes go towards transportation infrastructure perhaps we would need a combination of both programs.

Take a cryptocurrency backed on fiat currency, let's take FB libra, add a CO2 ledger based on the max. emissions for the 1,5C° scenario, i.e. carbon neutral by 2050. Citizens and unborns get a yearly CO2 budget and products are voluntarily sold at real price or carbon price included.